Carbon Credits Expire

Carbon credits (also known as carbon offsets) are permits to pollute less carbon dioxide than one would without them. They can be purchased by individuals or, more commonly, companies that want to offset their own emissions from industrial production and delivery vehicles. They are a great way for a company to be environmentally friendly and to help reduce climate change.

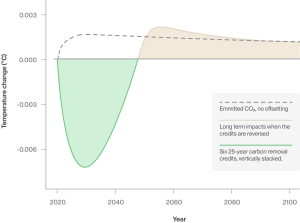

But do they expire? And, if so, what happens to all those millions of credits that have been bought and sold over the years? Unlike the fossil fuels that we use to generate energy, carbon credits aren’t a renewable resource. Once they are generated, they can’t be replaced — so it is vital that carbon projects have the right long-term horizon in place to ensure that all of their credits will be retired (taken out of the market forever) in the future, when the emissions reductions have been fully achieved.

The current voluntary carbon.credit market is largely unregulated, with the driving oversight provided by a handful of respected standards organizations that verify that carbon projects meet internationally agreed upon standards. While this approach may seem lenient, it has significant drawbacks. The most important is that carbon credits are based on “ex-post” accounting, meaning that they are performance-based but in arrears – the new credit cannot be issued until the project has been reduced and approved auditors have verified that reduction under internationally agreed upon standards. This creates a strong incentive for the market to overvalue carbon credits by underestimating their reversal risk and the implied risk to the climate system, and it also makes it easy for companies to tick the box of carbon neutrality when they really haven’t made any real commitment to reducing their own carbon footprint.

Do Carbon Credits Expire?

A credit’s reversal risk is measured by its discount factor, which is a function of the carbon price in the current period and the expected discounted long-run average carbon price. The lower the discount factor, the more valuable a credit is, and the more it can be used to mitigate climate change.

To protect against reversals, most programs establish a buffer reserve where credits can be retired if prices rise above the desired target. The size of the buffer pool is based on an assessment of a particular project’s risk for reversals.

As a result, the current price for most types of carbon credits tells a familiar story: the value they quickly gained in 2021 was slowly but surely lost in 2022. The question remains whether this is just a bump in the road, or a symptom of a much larger problem with carbon markets.

In order to avoid reversals, most carbon offset providers will retire the credits that they sell on behalf of their purchasers after each purchase. This can be done by marking them as “retired” on a variety of public carbon credit registries, where each credit has a unique serial number and can be tracked. CCC on a regular basis retires credits that we have purchased on behalf of our customers.